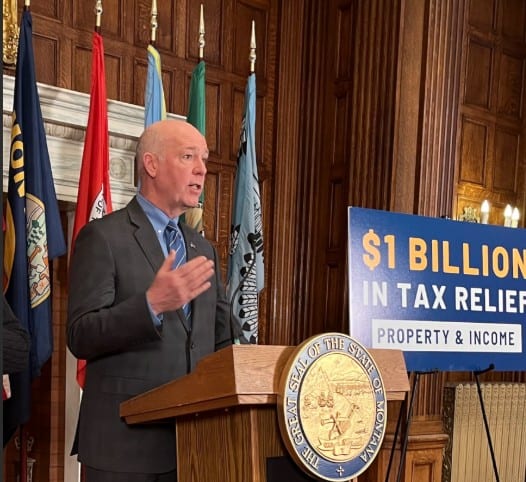

It’s now official…Property Tax Relief is on the way. Signed into law by Gov. Greg Gianforte last week, House Bill 231, carried by Rep. Llew Jones, a Republican from Conrad, and Senate Bill 542, carried by Sen. Wylie Galt, a Republican from Martinsdale, establish a series of systems to lower property taxes for Montana residents.

Appearing on the KGEZ Good Morning Show, Kalispell Rep. Courtenay Sprunger tells us the tax reductions are substantial. She says the estimates she’s seen for Flathead County are running 25-27%. The Department of Revenue is having to react quickly to the changes so we’re told it could be a bit “bumpy” at first.

But, there may be a fly in the tax relief ointment: litigation may be coming. Sen. Greg Hertz, a Republican from Polson, says the bills make our tax system the most complicated in the country. He says, “Various organizations and individuals, including myself, are looking into possible litigation of these bills and others.”

House Minority Leader Katie Sullivan, a Democrat from Missoula, tells us, “Over the next 18 months, Democrats will be holding the governor accountable to make sure everyone who qualifies for property tax relief gets money back in their pocket.”